Photo by Anna Tarazevich

If you are currently on the exciting path of purchasing a home in the dynamic city of Cincinnati, Ohio, you have likely encountered the term “closing costs.”

You may even have searched the internet about how much are closing costs in Ohio as part of your preparation for the fulfilling journey of buying your dream home.

Knowing these inevitable costs in a real estate transaction is crucial since it will significantly affect your overall budget before you can finally get the keys to your new home.

But what exactly do closing costs entail, and how do they affect your budget? Don’t worry; we are here to help you sort things out to manage these costs effectively.

Get ready to unlock the door to your dream home equipped with the necessary knowledge to overcome the drawbacks of closing costs!

Breakdown of Closing Costs in Cincinnati, Ohio

Photo by Karolina Grabowska

Closing costs usually account for at least 2% to 5% of the home’s purchase price.

As of April 2023, the average home sale price in Ohio is equivalent to $227,700, so your estimated closing costs when you buy a home in the area could be between $4,554 and $11,385.

However, closing costs are not only shouldered by either the buyer or the seller. In every real estate transaction, both parties are responsible for specific expenses in the closing process.

In this article, we will focus on the breakdown of the typical closing costs borne by home buyers in Cincinnati, Ohio.

Knowing these typical closing costs will help you prepare and manage your budget effectively throughout the real estate deal.

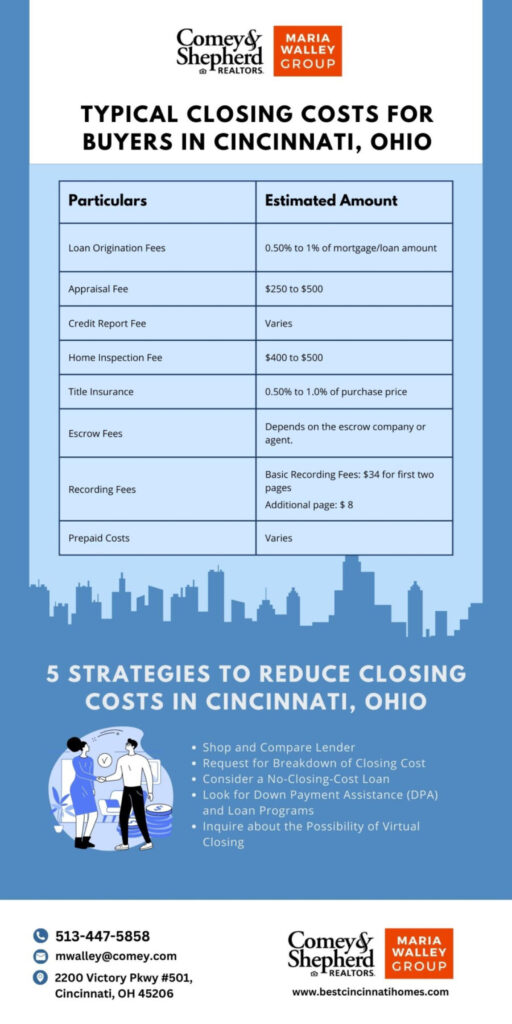

| Particulars | Description | Estimated Amount |

|---|---|---|

| Loan Origination Fees | This fee covers the administrative expenses incurred by the lender in processing the loan. It is typically calculated as a percentage of the loan amount. | 0.50% to 1% of mortgage/loan amount |

| Appraisal Fee | Fee paid for assessing the fair market value of the real estate. | $250 to $500 |

| Credit Report Fee | A thorough credit check is performed to ensure you are a responsible borrower. Your lender will request credit records from credit bureaus. For this reason, they will pass you any fees they incur from pulling your credit report. | Varies |

| Home Inspection Fee | Payment to a professional home inspector to evaluate the property's overall condition. They will check the functionality of the plumbing, HVAC systems, and structural integrity of the home. | $400 to $500 |

| Title Insurance | This fee serves as a safeguard for the lender in cases of any title-related complications. Buyers have the option to obtain an owner's title insurance to protect their interests. | 0.50% to 1.0% of purchase price |

| Escrow Fees | A title firm, attorney, or other impartial third party can act as an escrow agent and collect the fee. They facilitate the safe and timely exchange of funds, documents, and other assets between a buyer and a seller at a real estate closing. In Ohio, this is often negotiated between both parties. | Depends on the escrow company or agent. |

| Recording Fees | This represents the cost of having the deed and other legal documents recorded with the county government where the property is located. | Basic Recording Fees: $34 for first two pages Additional page: $ 8 |

| Prepaid Costs | Prepaid interest, mortgage insurance, and property taxes are all examples of Prepaid Costs. | Varies |

5 Strategies to Reduce Closing Costs in Cincinnati, Ohio

Photo by Mikhail Nilov

Knowing how much are closing costs in Ohio is not the only thing you should know about the closing process of purchasing a home.

Homebuying is a lengthy and costly process, and an inevitable part of the transaction is having to deal with closing costs.

These expenses can carry a significant financial burden on both the buyer and the seller. Although they are unavoidable, there are ways you can minimize them and make the process more manageable.

By being proactive and informed, you can navigate these expenses and come out with a successful transaction.

To help you have more budget flexibility to cover these costs, here are some cost-saving measures you can consider during the closing process. These can help you save money while going through the home buying transaction.

1. Shop and Compare Lender

Photo by Sora Shimazaki

One common and effective way to reduce closing costs is to compare loan options offered by different lenders.

By obtaining quotes from multiple lenders and comparing their fees, interest rates, and loan terms, you can identify the most advantageous financing alternative which fits your budget requirements.

Although it may take some time and effort to shop and compare lenders, it can save you significant money in the long run.

Be bold and ask questions or negotiate with lenders to lower the costs even further.

With the proper research and confidence, you can reduce closing costs and secure the best possible financing for your home purchase.

2. Request for Breakdown of Closing Cost

Photo by Tirachard Kumtanom

When obtaining loan estimates from different lenders, ask for itemized breakdowns of the closing costs.

It allows you to gain a valuable advantage by identifying fees that may be negotiable or unnecessary.

By comparing the estimates side by side, you can better negotiate and potentially reduce or eliminate specific excessive or redundant fees to maximize your savings.

3. Consider a No-Closing-Cost Loan

Photo by Andrea Piacquadio

Some lenders may also offer a “no-closing-cost” loan. In this case, the lender may cover some or all closing expenses but for a higher interest rate.

While it may seem like an excellent option to save money upfront, it could cost you more in terms of interest rates in the long run.

Carefully consider your financial situation and plans before choosing a no-closing-cost loan option.

4. Look for Down Payment Assistance (DPA) and Loan Programs

Photo by Mikhail Nilov

Ohio, including Cincinnati, has various down payment assistance programs aimed at helping qualified homebuyers cover a portion of the down payment or total closing costs.

DPA programs offer financial assistance in the form of grants, with relinquished or canceled debt, or loans with reduced interest rates.

If you are a first-time homebuyer or meet certain income and credit requirements, it may be worth exploring to see if you qualify.

Among the available DPAs in Cincinnati, Ohio, include the following:

| DPA Program | Description, Eligibility, Limit |

|---|---|

HomeBase Down Payment Assistance Program Contact Number: 513-334-3689 | Description: Available to low- to middle-income HomeBase members or those who live in census tracts with low- to middle-income levels. Eligibility:

Limit:

|

American Dream Downpayment Initiative (ADDI) Contact Number: 513-352-6146 | Description: The ADDI program facilitates homeownership, especially among low-income households. The program grants upfront funds for low-income first-time buyers of single-family homes, condos, or manufactured houses in Cincinnati. Ohio. ADDI grants are five-year non-interest-bearing deferred loans with a residence condition of at least five years. Eligibility:

Limit:

|

Ohio Housing Finance Agency (OHFA) Grants for Grads Contact Number: 888-362-6432 | Description: Fresh graduates can take advantage of the program's low mortgage interest rates. Also, if you stay in the house for five years without selling the property or getting a new mortgage, the program will reimburse your down payment and closing costs from 2.5% up to 5%! Eligibility:

Limit:

|

Taking advantage of these programs could save thousands of dollars and make homeownership more affordable.

Be sure to research and compare different DPA programs to find the best fit for your needs and budget.

Aside from DPAs, different loan programs are available to homebuyers in Cincinnati, Ohio, including FHA, USDA, and VA loans.

Researching and understanding the eligibility criteria for different loan programs can help you find one that suits your needs while potentially reducing closing costs.

5. Inquire about the possibility of a Virtual Closing

Photo by Mikhail Nilov

Discuss whether a virtual closing is an option by talking to your lender and closing agent.

Virtual closing can result in cost savings on transportation expenses or notary fees typically incurred when making a personal appearance during the closing process.

The prevalence and convenience of virtual closings have increased, enabling you to sign documents and finalize the closing process remotely and electronically.

Please keep in mind that every real estate transaction is unique, and the practicality of these approaches may differ depending on the situation.

We recommend seeking the guidance and expertise of a qualified real estate professional backed with extensive knowledge of the Cincinnati market. They can competently assist you in effectively reducing your closing costs.

Conclusion

Understanding how much are closing costs in Ohio is essential for both buyers and sellers in the area.

You can better prepare and budget by familiarizing yourself with the typical closing costs associated with real estate transactions. Knowing different strategies to minimize closing costs can also lead to significant savings.

Whether you are a buyer or a seller, consult with a knowledgeable real estate agent or attorney to navigate the complexities of closing costs effectively.

Remember, planning and effective negotiation can significantly reduce the financial burden of closing costs.

With careful consideration of closing costs, you can make the most of your investment in one of the flourishing cities in Ohio!

Ready to start your real estate journey? Contact me today at 513-447-5858 or via mwalley@comey.com for a high level of service, expert knowledge, and a commitment to deliver your dream home in Cincinnati, Ohio!

You can also visit my website and check out other real estate blogs for more in-depth information, helpful tips, and expert guidance about the housing market in Cincinnati, Ohio.

Stay connected with me on social media for regular updates and news about the city!

Photo by Mikhail Nilov

Frequently Asked Questions

How much are house closing costs in Ohio?

Closing costs usually account for at least 2% to 5% of the home’s purchase price.

As of April 2023, the average home sale price in Ohio is equivalent to $227,700, so your estimated closing costs could be between $4,554 and $11,385.

Do buyers pay closing costs in Ohio?

Like in any other state, the buyer bears most of the closing costs.

While there can be some negotiation, buyers are generally responsible for expenses such as lender fees, title-related costs, insurance premiums, and government fees.

Buyers are typically responsible for lender fees, title-related costs, insurance premiums, and government fees.

However, closing costs can still be negotiated between the two parties. While sellers may consider covering some expenses, buyers must be financially prepared to budget and take on most of the closing costs.

Do sellers pay closing costs in Ohio?

Yes, sellers often pay for costs such as real estate agent commissions and property transfer taxes.

Remember that the total closing costs are still subject to negotiations between the buyer and the seller. It may increase or decrease depending on the outcome of the agreed terms of the sale.